Originally published on Cloud Computing & SaaS Awards

Over the last decade, subscription-based pricing has been widely adopted across SaaS businesses in response to customers demanding less upfront product cost ownership. However, the tide is turning as customers are increasingly seeking hyper-personalization and flexibility in how they engage with products and services.

This shift is driving a new wave of SaaS businesses offering consumption-based pricing. Furthermore, moving to this model is not just about keeping customers happy and riding out a new trend. There’s proof in the numbers that consumption-based pricing yields higher revenue growth.

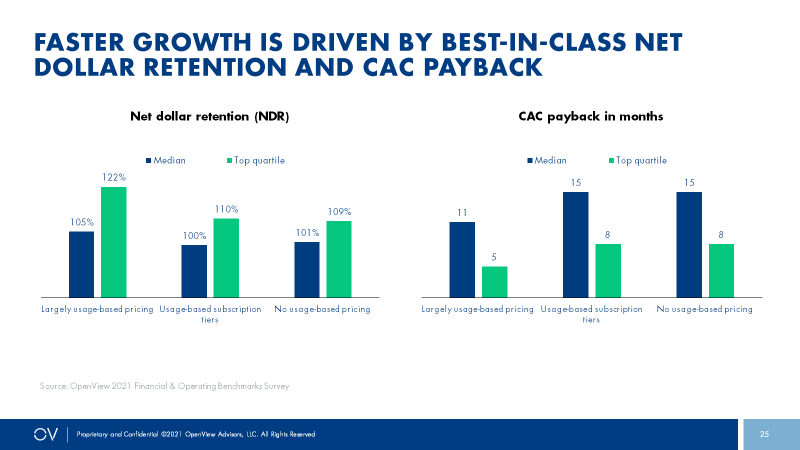

According to Kyle Poyar, Partner at OpenView, companies using the consumption-based model have:

- 38% faster revenue growth rate than their peers.

- Stronger net dollar retention rates (seven of the nine most recent IPOs of cloud companies have shown this).

- 50% higher revenue multiples versus the broader base of SaaS companies.

Let’s dive in to explore 5 reasons why SaaS businesses are turning to consumption-based pricing:

1. Taking seasonality into account

Every customer’s business has their own unique seasonal pattern with months where consumption of a product or service greatly increases due to their sales cycle hitting a peak and other months where usage decreases. Even within one specific industry, the cycle is never the same as each business has nuances due to varying customer bases, geographical regions and other external factors that contribute to fluctuating sales demand. Therefore subscription-based pricing is counterproductive, as it assumes a business is using a product or service the same way every month of the year. It ultimately contributes to resource waste and impacts the bottom line during the months where cost really matters.

Through consumption-based pricing, customers not only have the flexibility to pay as they use each month, but the SaaS provider ultimately has the opportunity to reap as much of the financial returns when their customers are riding through their peak sales cycle. Furthermore, new SaaS providers are also taking advantage of adopting a hybrid model that includes both subscription-based pricing, plus consumption-based pricing to capture additional usage.

This is an ideal strategy for businesses that have customers that incur significant ebbs and flows in usage from month-to-month. This way, SaaS providers can maintain a steady stream of subscription-based revenue throughout the year and leverage incremental dollars when customer usage hits a peak.

2. Enabling hyper-personalization

We are now in a paradigm where customers want the flexibility to hyper-personalize their products to suit their unique business needs and furthermore, have the agility to adapt those products as they journey through growth. Subscription-based pricing models assume that a business’s product needs are static from month-to-month.

Furthermore, bolting on other services on short notice can require a complete plan upgrade and issuing of completely new contracts. These upgrades ultimately end up impacting administrative time and detract from adding true product value to the end customer.

By adopting a consumption-based pricing model, SaaS businesses can have the agility to provide their products and services according to the unique usage needs of their customer’s at the time. They can also give customers the autonomy to personalize and add on services as usage fluctuates.

3. Enhancing data intelligence

Understanding customer’s usage patterns of a product or service can ultimately fuel data intelligence and provide valuable insights to inform future product innovation. These patterns reveal how customers also change their consumption over time and reveal opportunities to provide new products that might meet those emerging needs.

Furthermore, usage patterns can also be a reliable data input to model future revenue cycles for SaaS businesses, and also identify extenuating factors that impact usage. Whereas with a subscription-based model, it is difficult to understand how much a customer can truly ‘scale-up’ their usage as their consumption is capped within the framework of their current subscription plan.

Therefore a consumption-based pricing model gives SaaS businesses a much more granular picture of usage which could inform new opportunities to enhance products to meet customer’s emerging consumption needs.

4. Improving customer satisfaction

There is nothing worse than the feeling of paying for a subscription each month that you don’t necessarily use. The global pandemic has brought a lot of disillusionment and aversion to subscription plans, as many SaaS customers entered long subscription contracts pre-pandemic that they never ended up using, due to having to pivot and drive a different business model in the market.

This disillusionment impacts a customer’s perception of product value and ultimately leads to dissatisfaction and a cancelled subscription.

Contrary to this, if customers can be offered a pricing plan that is suited to their consumption needs at the time, they are going to feel a lot more satisfied that they are getting the most out of their product experience and that it is complementing their own unique business journey. Yes, this may mean that building revenue with this SaaS customer is a slower burn. However, in the long run, greater satisfaction will lead to increased customer retention and more sustainable revenue growth.

5. Driving product ROI

Not all customers need all of the bells and whistles that a SaaS business might have to offer in their subscription plans. Therefore a SaaS business might end up ‘giving away’ certain product benefits and features that ultimately never get used by the customer, leading to resource and overhead waste which can then negatively impact product return on investment.

Let’s say for example that a customer is given five hours of training support per month within a particular subscription plan. They may use that training for the first few months, but then appetite may decrease over time as their team becomes more savvy with their SaaS platform.

In this case, the business may still incur the cost of having to hire staff to cover those training hours which would go to waste. This then results in impacting the associated product cost for the SaaS provider. Through giving customers the autonomy to choose exactly what products and services they require and consuming as they go, supply is in sync with demand. It leads to less overhead and resource wastage and yields a greater product return on investment.

Getting started with consumption-based pricing

While we’ve discussed the factors of why a consumption-based pricing strategy is compelling for SaaS businesses, implementing the strategy requires robust operational business processes in order to ensure the strategy can be executed with precision.

Through using an advanced revenue management and billing software platform like OneBill, SaaS businesses can easily configure products attached to various usage metrics, ensure that customer usage is accurately rated, accurately calculate invoice amounts based on that usage and ensure the revenue from that usage is captured.